Navigating Global Governance in Today's Digital Economy

Interview by Farhad Muhammad – Gulan Weekly Magazine

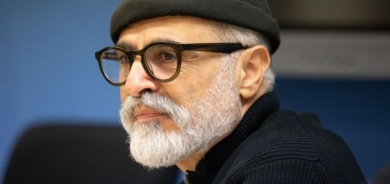

Bio: Dr. Rohinton P. Medhora

Dr. Rohinton P. Medhora is a leading voice in global governance, digital policy, and economic development. He served as President of the Centre for International Governance Innovation (CIGI) and has contributed extensively to policy debates on international cooperation, innovation, and inclusive digital economies. His work emphasizes the ethical and institutional foundations required for a fair, sustainable, and technologically adaptive world order.

Gulan: Mary Ellen Iskenderian's recent initiative aims to provide financial services to one billion unbanked women, leveraging mobile money platforms. How can global governance frameworks support such efforts to enhance financial inclusion, particularly for underserved populations?

Dr. ROHINTON P. MEDHORA: Combining financial inclusion with technology makes for a powerful force indeed. Done right, no one loses from financial inclusion because it brings previously unbanked or under-banked persons into the day-to-day transactional economy so essential to all our lives. It gives individuals the ability to conduct and manage their own financial affairs and makes them better citizens in every sense of the term. When linked to the ease with which modern mobile technologies function, they add speed and agility to our capability to operate in the modern economy. This is also a good example of social innovation, where the emphasis is not on advancing the leading edge of technology but harnessing existing technologies for the public good, for example, by making them easier to access and use, and creating network economies where more users in themselves enhance the effectiveness of a system or platform.

I find it remarkable that more than four decades after Muhammad Yunus’s pioneering work on micro-credit there are still significant numbers of unbanked people around the world. That the large majority are women or belong to marginal communities or regions shows how much more work remains to unlock the developmental benefits of a known and proven system. Clearly, national and international governance lie at the heart of this dilemma.

The bulk of the heavy lifting remains to be done at national and sub-national levels. They are best able to identify potential users, bring the technology to them in ways that are appropriate to local conditions, enhance financial literacy, and put in place the incentives and regulations for businesses and individuals to be opted into this amazing eco-system. But yes, there is room for global governance to make a difference as well.

Currently, the various national mobile banking and payments systems do not “talk” to each other – I can use my M-PESA account in Kenya to purchase something from a street vendor there, but not from one in India, for example. The harmonization of the rules governing mobile payments and banking and the interoperability of their technology backbones can only be done via countries cooperating with each other, in short, with global governance. The digital divide remains an issue in many parts of the world, and can only be bridged via concerted resources and action by the global community. The identification and facilitation of transfer of best practices is also best done by a regional or multilateral organization. Finally, although primarily a national responsibility, creating curricula and funding the improvement of education systems to include financial and technology literacy can be aided by an international organization. This is what I appreciate the most about organizations like Iskenderian’s Women’s World Banking. They use their global reach and influence to provide the cross-country governance that otherwise would not exist.

Gulan: The UK's Competition and Markets Authority has outlined a new strategy focusing on the impact of Big Tech on UK consumers, emphasizing a pro-business stance while addressing market dominance. What role should international regulatory bodies play in balancing innovation with fair competition in the digital sector?

Dr. ROHINTON P. MEDHORA: This is the crux of the modern public policy dilemma, isn’t it. Big Data and Big Tech hold great promise for humanity. We see its benefits all around us. But we are now also seeing its costs, which, in our zeal to seize the benefits we either glossed over, or they had not become apparent in the early stages. Take for example search engines like Google. In its early days, this was exactly the democratization of knowledge that the pioneers had told us about. But we forgot that knowledge is part of a continuum from data to information to knowledge to wisdom. We are only wiser if the data is of good quality, its results are not manipulated to turn them into misinformation and disinformation, and the driving technologies are not so proprietary that only a few get enormously rich via their monopoly power. One might say natural monopoly (or at best oligopoly) power because this appears to be inherent in the field – the more data you have, the better your product, the better your product the more users (customers) you have, the more users you have the more data you get, and with more data the cycle towards natural bigness perpetuates itself.

As a result, we are rediscovering regulation and competition policy issues that had perhaps fallen by the wayside in the tendency to see free markets as only a good thing these past few decades. The most direct way to tackle this issue is via fair taxation policies, so that monopoly rents are seen for what they are and taxed that way. It is important that the large tech firms, which are multinational and very savvy at managing their money, do not use tax loopholes and tax havens to shift profits around to minimize (I would say avoid) paying their fair share of taxes. This is why the OECD/G20 digital tax reform framework is so important – and an example of global governance backstopping the intent of national tax regimes. There are also calls to more directly harness Big Data for the public good. More can be done to regulate the content of digital platforms. One can conceive of establishing large diverse and globally representative datasets to, for example, enhance health care and health research. So-called data trusts can be enabled among individuals that willingly opt in to provide their personal data for a specified purpose or purposes, with the benefits from their use accruing to the “shareholders” i.e., the members of the trust.

But politics matters. It is said that it is no coincidence that the UK and the EU are leaders in digital platform regulation because they have no major (or even minor) platforms of their own to protect. By contrast, the “tech-industrial complex” is alive and kicking in the US (and I might add in China). The frontier here lies in harmonizing governance across countries while being mindful of the tremendous forces arrayed for and against greater regulation. And if this slows down innovation, is that necessarily a bad thing, given the benefits we have already seen, and the costs we are now incurring?